Signalling

- Archive

- Diageo Video

- Signal Box

'Signalling' Marris Steps for Balanced Growth Path

MARRIS PRINCIPLES

gd = gc

- Organic Growth

- Using Retained profits for R&D

- No acquisitions

- Diversification

- New product development

- Differentiation of existing products

- Dividends and Positive Learning Transfer

- Paying dividends to keep shareholders happy

- Building trust between shareholders and management

Step 1:

CEO SIGNAL“Our first priority is to grow the business that we currently have, so organic growth is a priority...secondarily, if we see opportunities for growth in acquisitions we will certainly seize those opportunities. In fact, I think we have a reasonable track record with that one.”

Paul Walsh, CEO, Diageo PLC

Step 2:

Key Ratios – Marris Financial Constraints

| 2002 | 2003 | 2004 | 2005 | 2006 | |

| Retention Ratio | 0.691 | -0.842 | 0.508 | 0.403 | 0.382 |

| Liquidity Ratio | 0.061 | 0.049 | 0.051 | 0.038 | 0.037 |

| Leverage Ratio | 0.271 | 0.252 | 0.230 | 0.211 | 0.241 |

- Retention ratio whereby the lower the ratio the higher the funds to pay dividends.

- The higher the rate of retained profits the greater the potential the organization has for growth.

- Liquidity ratio whereby too high a value increases probability of takeovers.

- Leverage ratio whereby the higher the ratio the more difficult it is to borrow.

Step 3:

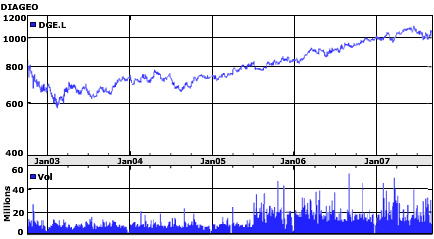

Diageo 5 Year Share Price

Share Price

- Share Price over 5 years showing increased value, with growth in Market Capitalisation of the firm.

- Security defence - reduces threat of takeover as per Marris.

- Share Price over 5 years showing increased value, with growth in Market Capitalisation of the firm.

- Security defence - reduces threat of takeover as per Marris.

Step 4:

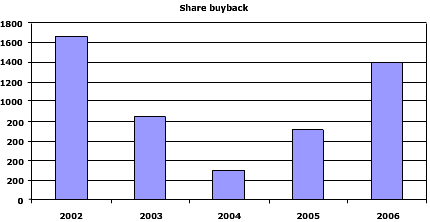

Share buyback

Share Buyback

- Share buyback is used as a management strategy to inflate the shareprice, thereby increasing the value of the company, in line with the Marris principles.

- This has enabled Diageo to begin a policy of acquisition (higher valuation provides better opportunities of obtaining finance for acquisition).

- Drop in share buybacks in 2004 is explained by the exceptional cost from disposal of Burgerking in 2003

Step 5:

Growth Curve

Growth Curve

- Share price - indicator of Value which is our security variable

- R&D - a proxy of gd

Step 6:

Signal Analysis- LISTEN to the video clip.

- Open the SIGNAL BOX.

- REPLAY the video clip.

- IDENTIFY the SIGNALS

| Diageo Signals |

|---|

| 1st SIGNAL = 'earnings up' +ve |

| 2nd SIGNAL = 'best profit ever' +ve |

| 3rd SIGNAL = 'guidance for coming year' +ve |

| 4th SIGNAL = 'organic profits' +ve |

| 5th SIGNAL = 'consumer spending' +ve and -ve |

| 6th SIGNAL = 'premium brands' +ve |

| 7th SIGNAL = 'marketing spend' +ve |

| 8th SIGNAL = 'exposure to US dollar' -ve |

| 9th SIGNAL = 'slow-down' -ve |

General Template

Likely Impact on the Share Price

Economic fundamentals signal

Investor signal

Probables/possibility signal

NB: KFIs such as EV, p/e, q-ratio, PSR, ROCE, are reported. The signals in this BOX are gleaned from video interviews with analysts and CEOs.

| Key Text | Signal | + Impact | - Impact |

| profit | results on upside | upside; organic profits; best profits | profit warning cash outflows declining markets |

| order book | seasonal | filled order books buffer | capacity constraints |

| earnings | earnings upside | Upside by xx% | less than market expectation |

| revenues | better than expected positive on revenues | upside | less than market expectation |

| costs | rationalise | outsource/rationalise cost savings target met | consolidate |

| demand | products brand identity holds | upside; premium brands; more consumer spending; increase in marketing spend | downturn; pedestrian; consumer numbers down; less consumer spending |

| geography | Europe v North; America v BRIC | growth in all markets; well positioned in growing markets | fall-off in sales in market X |

| dividends | surplus cash to investors | Mover; Return to shareholders | stock in 2nd row |

| change in profits | currency fluctuations | Due to FOREX less than expected; In some segments only | FOREX risk and exposure in some key markets |