Antitrust Analysis

- Oligopoly Model

The Bain-Modigliani Model

The model underpins the intuition behind the Chicago school of thought on anti-trust.

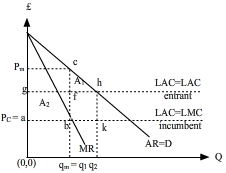

Figure 1 has the market demand curve AR = p which highlights the imperfect nature of the market. In other words, the incumbent firms, probably in a dominant position, interpret the demand curve as their own price curve. There is an attendant MR curve and the assumption is made that the incumbent firms have a structural advantage over the potential entrant. This is illustrated by the higher LAC curve for potential entrants than for incumbent firms. Assumption two is that incumbent firms set output and price targets at the MC = MR point which results in a total profit accruing to the incumbent firm of an amount [pmacb] and a per unit profit of [cb]. With the higher LAC the potential entrant anticipates a profit of [cf].

There are two strategies open to management of the incumbent firms:

1. Strategy So allow entry. As more firms enter the market downward pressure on price reduces the market price from pm to g. This is an excess supply response to the availability of products which increases from q1 to q2. At the level q2 the potential entrants just about breaks-even since p = LAC = LMC and the incumbents realise profits of [hk] significantly less than [cb].

2. Strategy S1 deter entry by threating to reduce the market price to level g which equals the LAC of the potential entrant. This is defined as the limit pricing strategy and for incumbents, profits fall to [hk] but the additional market share [q2 - q1] is entirely for the incumbents and not distributed with the entrants. Only if the potential entrants believe the threat - it is a credible threat - will limit pricing emerge as a strategy.

3. Strategy S2. The entrant may 'call the bluff' of the incumbent by entering anyway, and forcing the price to fall.

It is, however, anti-competitive under EC Competition guidelines. The assumptions which underpin this model afford an interpretation of the naive price theory cum barriers to entry reasoning that has become associated with a Chicagoan perspective on anti-trust. In essence, it is cutthroat competition. First of all the school argues that monopoly profits cannot exist unilaterally within a product-market. Either there is a threat of entry into the market which disciplines the incumbents to reduce price or any collusion within the market will break down due to an incentive to cheat amongst incumbents.

In the construction of Figure 1 we had assumed that potential entrants are at a structural disadvantage in entering a market. Once we allow for start-up costs such as advertising and plant location, many potential entrants are of a scale similiar to the incumbents and possibly larger than the incumbents. An incumbent brewery, for example, could not be put at a structural advantage over potential entrant breweries that would deter their entry on the threat of a price decrease from the incumbent.

Alternatively, larger firms may engage in market sharing (an alternative strategy S3) of [q2 - q1] - too much concern has been placed on price when the real anti-competitive action is on nonprice and market sharing arrangement amongst rival competitors. The incumbent firms are assumed to be profit maximisers - while this allows construction of Figure 8, profit maximisation in the short run may not be the objective of strategic management. Consolidation of market share or the launch of a new product are more likely objectives. The assumption of constant costs which translates into LAC = LMC in Figure 8 can be accounted for by the reserve capacity in large scale production. It accrues to both the incumbent and the potential entrant, so there is no guarantee that the entrant firm has a cost disadvantage as illustrated in Figure 1.